Once a vehicle is declared a total loss, customers often want to remove components they installed or would like to keep. Let me guide you through one of the most commonly asked questions from my customers when their car is totaled.

Can you remove parts from your totaled car? Parts can be removed from a totaled car, but the vehicles value will be reduced due to their absence. If you exchange the removed parts with a different type of component, expect the total loss value to be adjusted depending on the condition or type of part with which you are replacing.

After a total loss, the insurance company takes possession of your vehicle and auctions it off through one of its industry partners such as Insurance Auto Auctions or CoPart. It is in the insurance company’s favor to have the car intact so they can draw the highest bids at auction for these salvaged vehicles.

Is it Worth Removing Parts from my Total Loss Vehicle?

It is only worth removing or exchanging parts from your totaled car when they are worth significantly more than the total loss valuation assigns to them. In addition, the removal or exchange of these parts should not affect the valuation as much as the benefit of having them in your possession. You should also take into consideration the logistics of exchanging or removing the parts.

The insurance company will decrease the value of your vehicle if you remove parts such as the wheels, stereo, or battery. After all, the vehicle comes equipped with these parts from the factory and it is assumed the vehicle has these parts when the adjuster runs the total loss valuation.

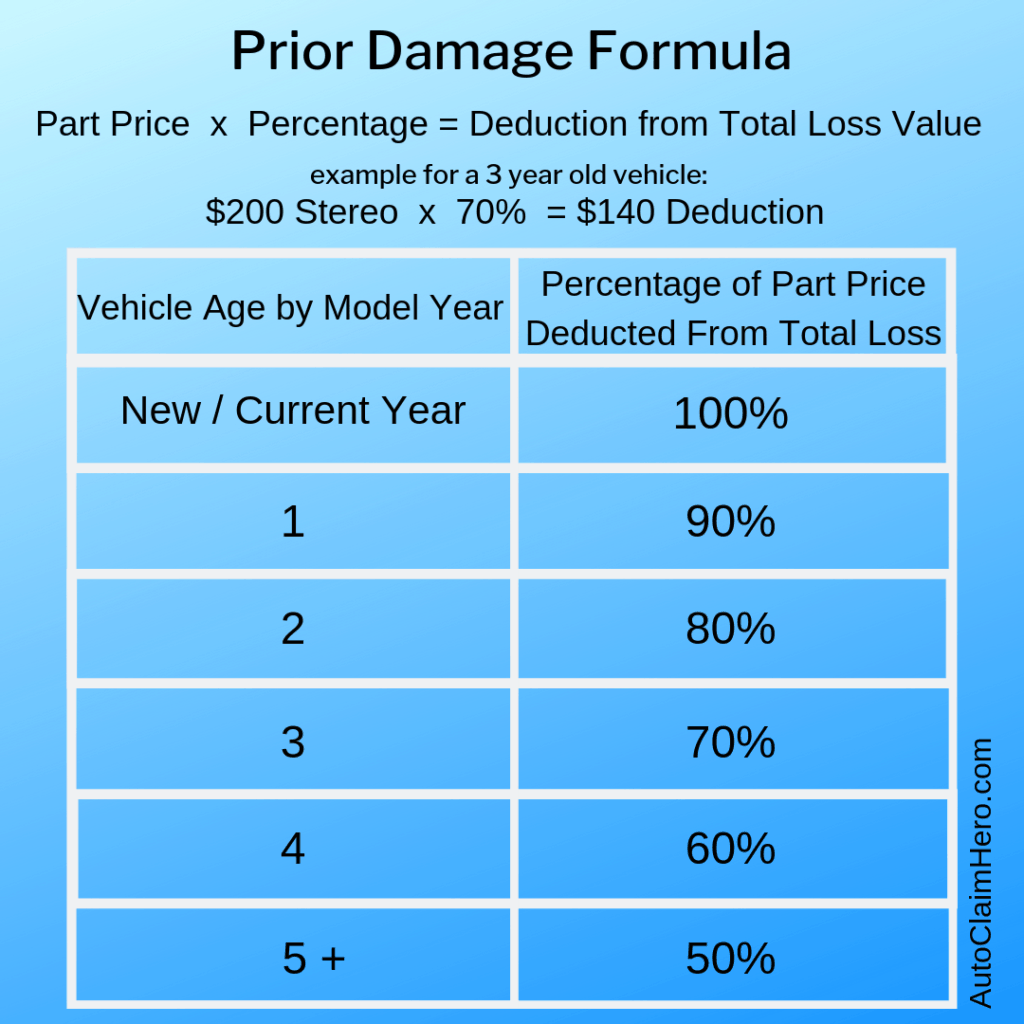

Thus, if you remove them, even after the valuation, the adjuster will write a prior damage estimate for the amount to replace those parts and then subtract that from the value of your vehicle. A prior damage estimate is also prorated depending on the age of your car as it is assumed some wear and defects are present when a vehicle ages. Below is an illustration of a commonly used prior damage formula.

Some insurance companies will subtract 100% of the prior damage estimate on a brand new vehicle. For a 5 year old vehicle, they can deduct 50% of the prior damage estimate. Even at a 50% proration, the cost of the deduction can be significant.

If the part you are removing can be replaced with a similar component then you are likely to have little or no reduction taken. The difference here is in the condition and type of part with which you are replacing the removed component.

If the replacement part has less features, or is in worse shape than what the vehicle is normally equipped with, then the adjuster will rerun the valuation and it will likely come back lower. If you are removing a part that was upgraded over what the car was equipped with from the factory, and you replace it with the original part for that model, your value will not be impacted. You will retain the more expensive part as the benefit. But is this worth all of the time and hassle?

You will also have to factor in the logistics of the parts removal or exchange. Depending on where your vehicle is, a tow yard, a body shop or total loss yard, it is at the discretion of the property owner to allow you to remove the parts. Most locations only provide access to customers to remove personal items and not parts of the vehicle.

Removal of some larger components such as wheels or toolboxes can be considered a mechanical operation and the property owner might only allow their mechanics to remove these parts, who you will have to pay. Removal will also have to be conducted during work hours as most body shops and storage locations are not open to customers after 5pm or on weekends.

Locations such as Insurance Auto Auctions or CoPart typically do not allow the removal of any parts and only provide monitored access to remove your personal items.

Before you proceed with exchanging parts, ask the adjuster ahead of time how the total loss value will be affected. They can call the valuation company and run different scenarios by them, depending on what you want to have removed, to see if it is worth your time. Additionally, the adjuster can also write a prior damage estimate to see how much any deductions for part removal or exchange will affect the value.

I have had a few customers that mistakenly assumed a totaled vehicle goes to the junkyard after the accident. These customers removed multiple interior and exterior components such as the spare tire, jack, stereo, battery, light bulbs, etc. The deduction for these missing components was so high that they returned to the vehicle and reinstalled all of the parts. If they asked me first they would not have wasted all of that time and effort.

There are a variety of scenarios in which exchanging or removing parts from your totaled vehicle can either be cost effective or not worth the time and effort. Below is a guide covering the most commonly removed parts, how your valuation can be impacted, and whether it can be worthwhile to remove these parts.

Can I Remove Aftermarket Parts from a Totaled Car?

You can remove aftermarket parts from your totaled car as long as you replace them with the original factory part. If the aftermarket part is not replaced, then the insurance adjuster can subtract the cost of the missing part from your total loss value. You have to exchange parts before the insurance company takes ownership of your car.

You will never get the full value of the aftermarket part in your valuation so it can be more cost effective just to swap the part out. The insurance company does not care if you upgrade your stereo to a better brand, if it provides the same functionality it will not add value.

If you add a CD player, or Bluetooth functionality on top of a basic a radio then you will get $30 at most, at which point it can be cheaper swapping out your aftermarket radio with the old one.

If your car has not been inspected by the insurance company than you should be fine swapping parts out. Make sure to let the insurance adjuster, which is the person that inspected your totaled car, that you are removing aftermarket parts if they already inspected it. If they come across your vehicle again after they inspected it or the parts are removed before, this can affect your value.

Can I Remove Wheels and Tires from my Totaled Car?

You can remove wheels or tires from a totaled car but, you have to be able to replace them with another set, or there will be a deduction in the value of your total loss. Your total loss value will be significantly reduced if the vehicle is missing its wheels.

There are a variety of factors that determine if it is worthwhile to keep your wheels or if it best to let them stay on the car.

Let’s use the example of a totaled 2015 Ford Escape. You recently had custom aluminum rims and tires installed on it for $1800. You also have the original set of wheels with very worn out tires in your garage.

The insurance valuation only you gives you an extra $85 towards the value of your vehicle because of the new tires. This is determined when the adjuster inspects your vehicle and measures the condition of your tires with a tread depth gauge.

But you paid $1800 for the wheels, why doesn’t that value increase by that much? If your specific 2015 Escape model already comes with aluminum wheels from the factory, you will not get any added benefit for having custom wheels.

Changing the style and appearance of the wheels does not add value as it is a personal preference. The valuation does give you an extra $85 for the having like new tires since the tire tread measurement is better than what the total loss valuation company considers average.

Most used vehicles are not sold with brand new tires so the adjusters measurement of your tread shows it is better than average. Since a vehicle comes standard with tires, your new tires only increase the value of the car incrementally as someone would theoretically pay more for a car with newer tires than for one with average tires. No consumer though would pay the full amount of what you paid for the tires on top of the value of the vehicle.

Since you have the original wheels and tires in your garage, you decide it is worthwhile to put this worn out set on your totaled Escape and to remove and the new set. You ask the adjuster how much this will change the value and they say they will have to reinspect the wheels and tires to make an adjustment to the value.

Now the adjuster re-inspects your vehicle, grades the tires below average and the valuation is deducted by $85, reflective of the tires’ poor condition. You are still ahead $1715 since you had a spare set of wheels and tires. In this scenario. it would be worth exchanging the wheels if you are able to do this yourself, without paying anyone and you have the logistics worked out.

Now that you have the wheels and tires, will you be able to use them on another vehicle? Wheels are not universal, even if they have the same bolt pattern, dimensions such as wheel offset, center bore size, and backspacing vary for every make and model.

If you plan on using the wheels on another vehicle, make sure to check these specifications. You can use this website to check wheel compatibility and specifications between makes and models. If you plan on selling your wheels, be aware that you will not get what you paid for them.

The most common place to sell wheels and tires is on Craigslist. Parts almost never sell for face value there. Also, there are a variety of pitfalls with meeting random people to sell your wheels and tires. You can deal with people that will haggle below an acceptable price, others are no-shows, and you will have to make arrangements to meet up in a safe public area to complete the transaction.

Nevertheless, if handled correctly, Craigslist can be a very helpful. Check out this article on how to setup a successful Craigslist transaction.

Removing the Wheels and or Tires from your Car will not be Worthwhile if you:

- Do not have a replacement set

- Your replacement set is significantly different from what the vehicle was equipped with (replacing aluminum rims with steel wheels will be a reduction in value, bald tires will be a reduction in value)

- The tow yard or body shop where your car is does not allow you to remove them

- The deduction from the total loss value is significant

- You do not have any use for them after removal or do not want to deal with the hassle of selling them

Removing the Wheels and or Tires from your Car is Worthwhile if:

- You have a replacement set of wheels that is in good condition and similar in style to put back on the vehicle

- You have permission to exchange the wheels from the storage location

- The deduction from the valuation is minimal, if any, after replacing the wheels

- You have a use for the wheels or are comfortable selling them on your own

Can I Remove Aftermarket Stereo or Speakers from a Totaled Car?

Yes, you can remove an aftermarket stereo or speakers from totaled car but unless you replace them with the original factory parts, the total loss value will be reduced.

When a stereo is inspected during a total loss valuation, the adjuster will review its options and features. Unless you have added a stereo with navigation, satellite radio, or a multiple CD changer, the additional value that an aftermarket stereo can provide is minimal. If the only difference between the original stereo in your car and the aftermarket one is Bluetooth, then your value may increase by as little as $15.

If you added a stereo with navigation and the total loss valuation does not provide a sufficient value for this feature, it might be worth having the navigation unit in your possession and just replace the original radio back into the car.

If you decide to remove the aftermarket stereo from your car without replacing it with the original one, then the adjuster will write a prior damage estimate and subtract that from your valuation. Make sure to ask the adjuster how much this deduction would be before you go ahead and remove the stereo, it almost never is worth it unless you have a navigation head unit.

As with any part exchange or removal on a total loss vehicle, the auto damage adjuster will re-inspect the car and make sure nothing else was changed or removed.

Aftermarket speakers on the other hand, that were installed in replacement of factory speakers will not add any value to the vehicle. Exchanging them is almost always worth it, if you can do the work yourself.

If you had a separate CD changer installed and the value to the total loss you are receiving for the changer is not adequate you can remove this as well. Same goes for a satellite radio unit that you added to the original stereo. Make sure to remove all of the antennas and cabling that are part of this system, as without them it will be useless.

Removing a Stereo from a Total Loss Vehicle is Worthwhile When:

- You have the original stereo with which to replace it

- The stereo is worth more than the reduction in the total loss value

- You are capable of doing the replacement yourself as paying someone would not be cost effective

Removing a Stereo from a Total Loss Vehicle is not Worthwhile When:

- The prior damage estimate is higher than the value of the stereo

- The facility where the vehicle is located does not allow you to remove parts from the car.

- The difference in value added from the aftermarket stereo and the original radio is minor

Can you remove the battery from your totaled car?

The battery is another common part customers want to remove from their vehicle.

You can remove the battery from a totaled car but the total loss value will be reduced because the battery is missing, unless you swap it out with another battery.

Most often the question is about keeping a newly installed or a premium battery such as an Optima.

Unless you have the old battery to replace the new one with, then the adjuster will write a prior damage estimate, removing value from your total loss, for the vehicle not having a battery. You can always ask the adjuster to complete a prior damage estimate to determine how much they will be subtracting from the value of the car before you make your decision.

Additionally, the battery could have been damaged from the impact. Even if the battery looks physically intact, internal components such plates and electrodes could malfunction. The battery will still work and hold a charge but its lifespan could be reduced, making the battery unreliable in the future.

You will also have to make sure you can open the hood, as sometimes a frontal collision can jam the hood in-place and make it hard or impossible to open making it not worthwhile to remove a battery from a totaled vehicle.

Removing a Battery from a Total Loss Vehicle is Worthwhile When:

- You have another battery to replace it with

- You have a premium battery installed such as an Optima

- The prior damage estimate for not replacing the battery is low enough compared to the price of the battery you are removing.

Removing a Battery from a Total Loss Vehicle is not Worthwhile When:

- The hood on the vehicle is crushed or jammed shut

- You do not know how to remove it

- The storage location of the vehicle will not allow you to remove any parts

- You have an old battery as a replacement

- The prior damage estimate is too high to make keeping the battery worthwhile.

Removing Performance Accessories from your Total Loss Vehicle

In order to achieve higher horsepower and enhanced drivability, automotive enthusiasts will install performance parts such as air filters, air intakes, larger brakes, tuned suspension parts, and high flow exhausts. Performance parts almost never add value to a total loss. This is a personal preference and valuation companies rarely take these additions into consideration.

Many of my customers, who have these parts installed, ask to have them removed, and fortunately, many of them still have the original parts at home. Without having the old parts, the adjuster will write a prior damage estimate reducing the total loss valuation reflective of the price of the removed part after it was run through a depreciation calculator.

Additionally, some components would be difficult to remove from a totaled car. Parts such as shocks, brakes and exhausts require a vehicle to be lifted and special tools for removal are needed. This type of disassembly is impossible in a storage yard and moving a totaled vehicle to a shop to have the parts removed would be cost prohibitive.

A rental car would also not be approved or extended for these delays and your total loss payment will be postponed.

Removing Performance Parts from a Total Loss Vehicle is Worthwhile When:

- You have the old parts to replace those taken from the car

- The deduction from the total loss value is not significant

- The part is expensive and worth selling or using on another vehicle

- The part does not add any value to the total loss

- The part is not equipped standard from the factory so removing it will no deduct any value

Removing Performance Parts from a Total Loss Vehicle is not Worthwhile When:

- You are not technical enough to remove the parts yourself

- Paying someone to remove the parts is cost prohibitive

- The vehicle requires a shop to remove the parts (vehicle needs to go onto a lift, special tools are needed)

- The parts are inexpensive and not worth reselling

Keeping the Bed Cap or Toolbox from your Totaled Pickup

Most valuation companies do not price these parts as much as you would pay for them out of pocket or even for as much as you can sell them on Craigslist. They will give you the same value for your bed cap regardless if it is a premium Leer cap or a secondhand faded and cracked bed cap.

The same goes for a bed mounted toolbox. There is a wide array of available toolboxes for sale; the valuation company will only increase your value by the same amount regardless if you have a polished aluminum box or a worn out plastic box.

Detaching a toolbox does not require many tools but removing the part could require two or three people due to its bulkiness and weight.

Removing the Bed Cap or Toolbox from your Totaled Truck is worthwhile when:

- You have a use for the bed cap or toolbox on another vehicle

- You can sell the parts for a profit on Craigslist

- You are capable of removing the parts yourself

Removing the Bed Cap or Toolbox from your Totaled Truck is not Worthwhile when:

- The storage location of your truck prohibits removal or parts

- The bed cap or toolbox are in poor shape or do not have much resale value

- You do not have another vehicle to use the bed cap or toolbox on

- You are fine with the value of these parts on the total loss report

Can I keep the Floor Mats from my Totaled Vehicle?

If your vehicle is of the current model year, the removal of floor mats will decrease your value. If your vehicle is 1 year or older, then you are probably fine to remove the floor mats. Most insurance companies do not take floor mats into consideration after 1 year. Check with your adjuster to be sure.

If the adjuster states you need floor mats in the vehicle, but you like the factory ones or have premium floor mats such as those from Weathertech, you can always replace them with a low priced set from Amazon. You can get decent floor mats that meet the requirement from the valuation company for under $20 and will then avoid any deduction from your valuation.

Removing the Spare Tire and Jack From your Total Loss

The spare tire and jack are considered standard equipment on the vehicle and removing them will decrease the value of your total loss. The adjuster will write a prior damage estimate reflective of the value of these parts, run it through a depreciation calculator, and subtract this amount from your total loss value.

It is not worth removing these parts, unless you have another similar vehicle, as the spare tire and jack are vehicle specific and carry little value in the aftermarket. If you insist on taking them, make sure to ask the adjuster for a prior damage estimate to be sure how much your value will be reduced.

Removing Personal Items from a Total Loss

By the time I get to inspect a vehicle and declare it a total loss, the customer usually has already emptied out their personal belongings. I still manage to find items that customers forget, requiring them to return to the vehicle. Make sure to check all storage compartments. Look in all of the doors, the center, rear, and overhead console as well as trunk storage.

Remember, your total loss vehicle will be sold at an auction and can end up anywhere after it is purchased. Make sure to remove any personal identifiable documentation from the glove box and vehicle manual. Maintenance and insurance documents have your name and address on them so take those with you. Also make sure to erase any phones and data from the navigation system memory.

Here is a list of the most common personal items the customers forget from their total loss vehicle:

- Garage door opener

- Cell phone charger

- Documents in glove box (there is no need for the vehicle records to be left with the vehicle, they usually have personal information on them)

- License plate

- Toll transmitter (E-ZPass, FasTrak etc.)

- Sunglasses

- Coins

- CDs

- Jumper cables and any personal tools in the trunk

- Seat Covers

Final Thoughts

If you decide you do not want to remove any upgraded parts but do not agree with the total loss valuation, you can always provide the adjuster a receipt for the parts in question. The adjuster will forward this to the valuation company and they can take the costs into consideration and possibly increase the value.

This process is called a refurbishment adjustment. The valuation company considered your car refurbished since you improved it with newer or extra parts, so they increase the value reflective of their calculations. The increase is never full face value and depends on when and what type of part was added.

Refurbishments add anywhere from 5% to 25% of the part price back towards the value. It is minimal but still better than nothing if you decide not to remove the part from the vehicle.

If your vehicle hasn’t been declared a total yet and you are researching your options, you can learn more about how to make insurance total your car or how to stop insurance from totaling your car in the linked articles. Additionally, you can learn more about keeping your entire totaled vehicle and how to negotiate for and extended rental coverage. Finally if you are having a hard time working with your insurance adjuster check out this article: 8 tactics to help deal with an insurance adjuster.