In order to have a vehicle totaled, repair costs have to exceed the total loss threshold. Total loss thresholds are between 70% to 100% of the the vehicles Actual Cash Value (ACV), depending on your state.

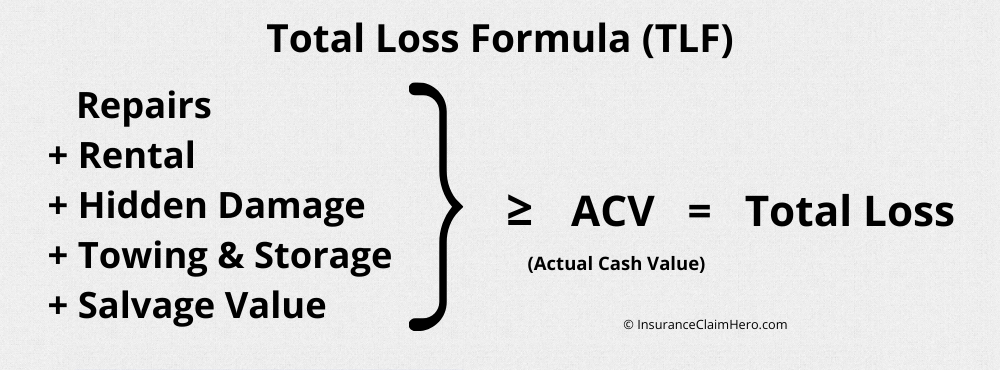

If insurance doesn’t want to total your car, the adjuster can use a Total Loss Formula (TLF) to increase the repair costs to meet the total loss threshold. The cost of hidden damage, towing, storage, rental, and salvage value can be added to the TLF.

This method is called a constructive total loss, where reasonable assumptions of hidden damage are made in advance that could be found during repair along with other costs.

Constructive total loss estimates are written when repair costs come close to the total loss threshold. Insurance companies want to avoid repairs close to a vehicle’s value since a vehicle can also total financially during extensive repairs.

In this situation, the insurance company will have to pay the customer for the value of the car and the body shop for parts and labor, essentially paying double for the claim.

If your insurance company does not want to use the Total Loss Formula, then you will have to provide additional damage information or convince the adjuster to constructively total the estimate.

How to Determine you Total Loss Threshold.

The repair estimating software insurance companies use will alert the adjuster to run a market valuation when repair costs are close to the total loss threshold. This alert is based on an approximate value assigned to the vehicle saved in the estimating software.

Thus, if the repair cost is not high enough to trigger an alert, the adjuster will not run a market report to determine the vehicles ACV.

In this case, you would have to check Kelly Blue Book or the National Auto Dealers Association guide to get an approximate value of your vehicle. These online resources are not as accurate as a market report but they will be close enough to determine how much additional damage is needed to breach the total loss threshold.

You can use the total loss calculator below to see how close you are to the total loss threshold.

How to convince an insurance company to total your vehicle.

In order to have the repair estimate increased enough to breach the total loss threshold, there are a variety of techniques that can be employed to help convince the adjuster to complete a constructive total loss.

Keep in mind that these techniques will only work if your vehicle is not extraordinarily expensive and the repair cost is 50% or higher than the vehicle’s ACV. If repair costs are 50% or less, it is unlikely there is enough hidden damage to financially total the vehicle.

Techniques to convince the insurance company to total your vehicle:

- Ask the adjuster for a market report to determine your vehicles Actual Cash Value. By having an official market report total loss value, you will know how much more costs are required to financially total the vehicle, and if it is possible to do so.

- Point out hidden damages that the adjuster might not realize. Issues such as the engine not starting, the transmission did not shift correctly, or the alignment is off. If your vehicle was pushed off the road, let the adjuster know this because there could be additional undercarriage damage to the frame, suspension, or exhaust system.

- Tell the insurance company you are taking the vehicle to the dealer for repairs. Decline using the insurance company’s recommended body shop since this shop usually will charge the insurance company less than another (non-recommended shop). Dealership manufacturer approved body shops usually charge more and take longer to repair, incurring higher rental bills and multiple estimates.

- Insist on only using OEM parts and not cheaper recycled or aftermarket parts. Insurance companies try to save money by using cheaper used or non OEM (Original Equipment Manufacturer) aftermarket parts. You can fight the use of non-OEM parts by indicating their inferiority and saying you will have another body shop extensively scrutinize repairs.

- Using social media to expose the insurance companies unwillingness to total your vehicle. You can reach out to the insurance companies Twitter and Facebook accounts. Adding your claim number and calling out the name of the adjuster, their supervisor and all of the management above them including the VP and CEO can get enough attention to make your problem “go away”. You will get extra attention if you can prove lack of communication, slow response time, or rudeness publicly, especially if you have recorded phone calls or documentation.

- Tell the adjuster you will fill out their Customer Service Survey. Adjusters’ salaries and raises are based on their customer service survey scores. If the adjuster knows you are unhappy with your claims experience and that you will be looking forward to their survey, they might take extra steps to ensure your satisfaction. For more help on dealing with an adversarial insurance adjuster I go into steps and tactics in my article, “How to Deal With an Auto Insurance Damage Adjuster – 8 Tactics“.

Keeping your totaled vehicle.

You can keep a totaled vehicle as long as there is no lien holder on the title. The salvage value of the vehicle will be subtracted from the total loss settlement along with the deductible.

Depending on your state and age of the vehicle, the title might need to be branded “salvage”. I go into greater detail about buying back your vehicle from insurance in my article: Can I Keep my Total Loss After an Accident?

If you do not want your vehicle totaled, I go into the tactics and methods on how to prevent auto insurance from totaling your vehicle in this article, How to Stop Insurance from Totaling your Car.