There are many factors to consider when it comes to buying back a vehicle that has been declared a total loss from the insurance company.

So, can you keep your total loss? Yes, auto insurance will let you keep a totaled car but the vehicle’s salvage value will be deducted from the total loss settlement. If there is a lienholder on the title, then the lien will have to be paid off.

Depending on the age of the vehicle and your state, the DMV may require that a title be rebranded “salvage” once a vehicle is declared a total loss.

What is “Total Loss Salvage Value” and how is it Calculated?

Salvage value is how much a totaled vehicle will sell for at auction in its current damaged condition.

To obtain a salvage value, the insurance adjuster calls one or more licensed salvage dealers to obtain salvage bids.

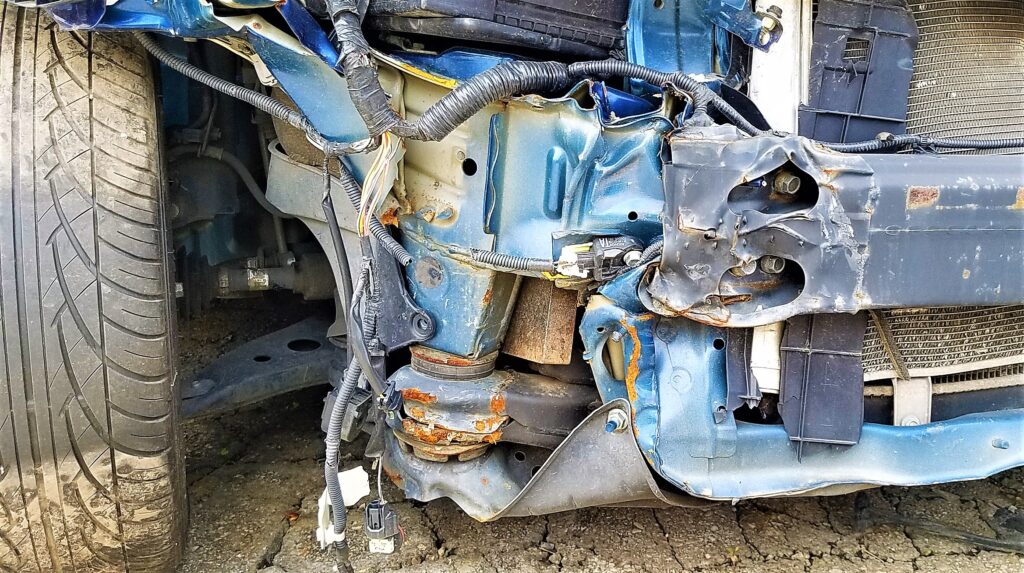

Salvage bid prices are based on the vehicle’s year, make, model, mileage, type of damage, severity and location. Additionally, the salvage dealer will ask if the vehicle runs and drives, if the airbags were deployed, or if the vehicle was flooded to gauge how much the vehicle would yield at auction.

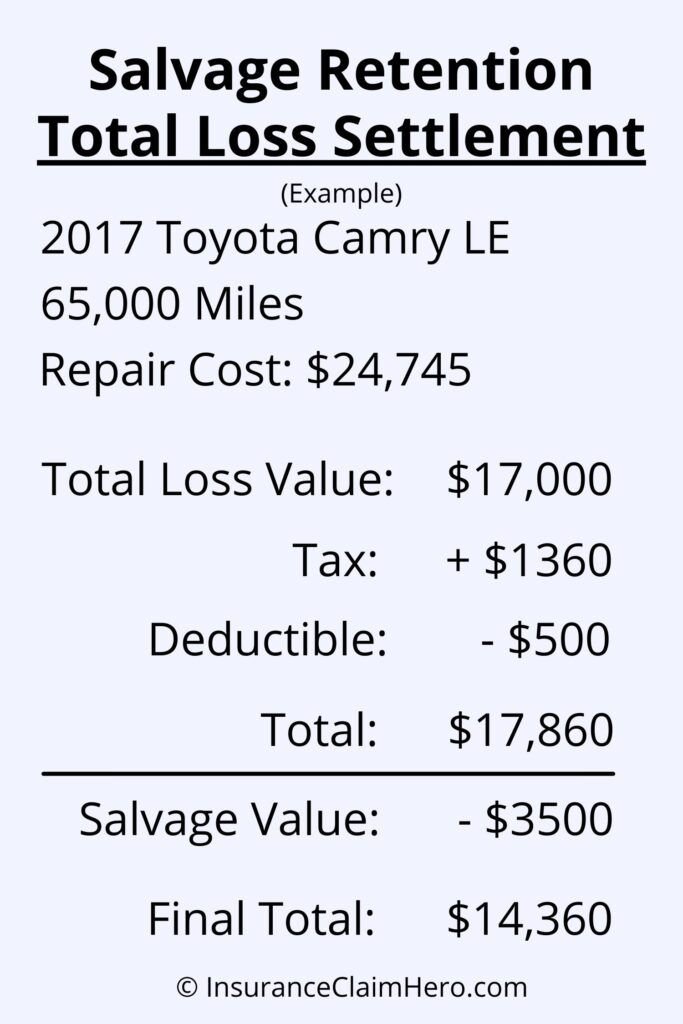

The salvage dealer then provides a quote based on this information and the adjuster will subtract this amount from the total loss settlement.

In summary, the salvage value is the amount it costs to buy back your totaled car from the insurance company, as this is how much the the company would have made by selling the vehicle at auction.

Depending on your state, more than 1 salvage quote may be required and the bidder’s contact information and quote number must be provided to the customer. Customers who keep their total loss are typically have 30 days to change their mind and sell their vehicle back to the salvage yard from which the insurance company obtained the salvage quote.

I have more information about total loss vehicles auctions in the article “What do insurance companies do with totaled cars“.

How to Dispute a Salvage Value that is too high.

If the salvage value your insurance company provided to you is too high, it is your right to ask the adjuster for the quote and the contact information of the bidder.

Call this bidder and verify they received the correct description of your vehicle’s damage. It is possible the bidder could reconsider their estimate and lower it.

If you received only 1 bid, see if the adjuster, or you personally can get more bids that are in your favor. Remember to obtain a quote number and name of each person with whom you spoke.

Should I buy back my totaled car?

Insurance companies total vehicles because the repair cost exceeds the value of the vehicle. If you are keeping your totaled vehicle to repair it, consider the fact that the insurance company determined repair was not economically feasible.

This means that the cost of parts, paint, and repair labor cost more than the vehicle’s worth. You will also have to tow the vehicle to your house or repair shop (that can charge storage if you do not have the money for the repair).

Even if you manage to get a discount on parts and labor, you will end up with a salvage branded title and vehicle that was rebuilt and now has reduced resale value due to the fact the vehicle was previously totaled.

Now if the vehicle is totaled due to cosmetic reasons such as being keyed or dented, and it is still safe to drive, then it might be worthwhile keeping the vehicle if the buyback amount is minimal.

To total or not to total.

Depending on your situation and the amount of damage, you may want the insurance company to total your vehicle or to avoid it from becoming a total loss.

I have 2 articles that go into the methods and tactics that can be used to help convince your insurance company, How to Make Insurance Total Your Car and How to Stop Insurance from Totaling Your Car – Tips from an Adjuster.